Industrial Competition

The theory of social Darwinism is based on Charles Darwin’s survival of the fittest theory. Social Darwinists believed that individuals should have the freedom to pursue success and either succeed or fail. Those who failed or did not try would benefit from the success of those who were “fit” enough to succeed. In order for the “fit” to succeed, the government should not interfere. Under the theory of social Darwinism, corporations had to compete in order to succeed.

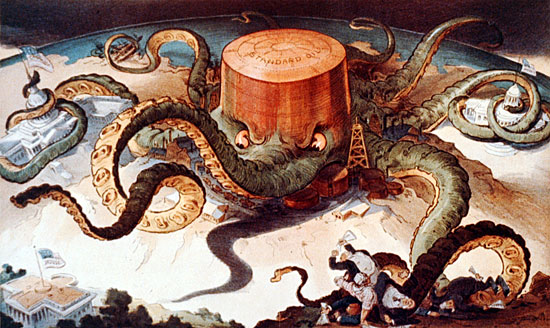

In order to succeed, companies had to gain a competitive advantage. Controlling the price of a good or service could provide this. One way to control the price was to monopolize the good or service. Some companies tried to gain a competitive advantage by gaining enterprise monopolies, so that when a consumer wanted the good or service, there was only one place to go to get it. Vanderbilt, Morgan, and Rockefeller tried to monopolize the railroad, steel, and oil industries. There are different ways to gain a monopoly. How does the picture below characterize Standard Oil?

Cartoon depicting Standard Oil

Rockefeller used a horizontal integration structure by buying up oil refineries and consolidating them into one company. He formed a large corporation of a single enterprise. Andrew Carnegie used a vertical integration structure. He bought businesses at each phase of steel production development to control all phases of the process and keep prices low. This is called “economies of scale” and was used to drive competitors out of business.

|

|

|

Instead of buying up companies that produced similar products, some company owners formed informal alliances called cartels with other business owners who produced a similar product. As a cartel or pool, they could agree to limit the supply of the product and drive prices up. They would also agree to divide market areas so that each member of the cartel would prosper. Business owners could also form trust agreements with other business owners who owned a majority of stock in a similar product. When a business man owned stock in a company, he owned a percentage of the company. Therefore, as a trust, they could work together to limit competition.

As large corporations grew, some workers began to feel that too much wealth was being concentrated with a few people and not distributed widely. Critics of monopolies and trusts began to characterize tycoons as corrupt. The term “robber baron” was used to describe big business tycoons. Social Darwinism was used as the rational defense by the tycoons to legitimize their business ventures and structures.